Small Business Development Center

Small business owners and aspiring entrepreneurs can go to their local Small Business Development Centers for free face-to-face business advising and low-cost training on topics including: business planning, accessing capital, marketing, regulatory compliance, technology development, international trade, and much more., are hosted by leading universities, colleges, state economic development agencies and private sector partners, and funded in part by the United States Congress through a partnership with the U.S. Small Business Administration. There are about 1,000 SBDCs available in the U.S. and many U.S. territories to provide no-cost business consulting and low-cost training to new and existing businesses. For more info on SBDC services, please call Laura Kunefke at 281.425.6309.

Visit the Texas Gulf Coast Network Region website

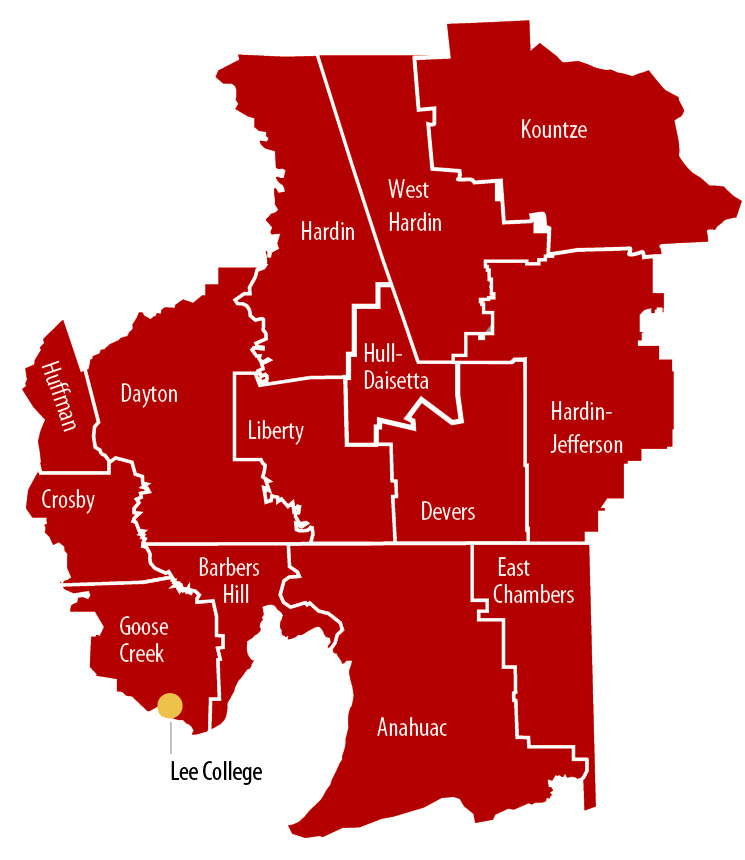

The Lee College SBDC is a service provider of the University of Houston Texas Gulf Coast SBDC Network, a business advising and training program serving 32 counties in Southeast Texas. The UH Texas Gulf Coast SBDC Network is a program of the UH Bauer College of Business and a resource partner of the U.S. Small Business Administration (SBA). The SBDC is funded in part through a cooperative agreement with the U.S. Small Business Administration.

More information:

Phone: 281.425.6556

Fax: 281.425.6307

Victoria Jaramillo

LeeCollegeSBDC@lee.edu

Location:

909 Decker Dr

Baytown TX 77520

Hours:

Mon.-Thu.: 7:30 a.m.-5 p.m.

Fri.: 7:30 a.m.-12 p.m.